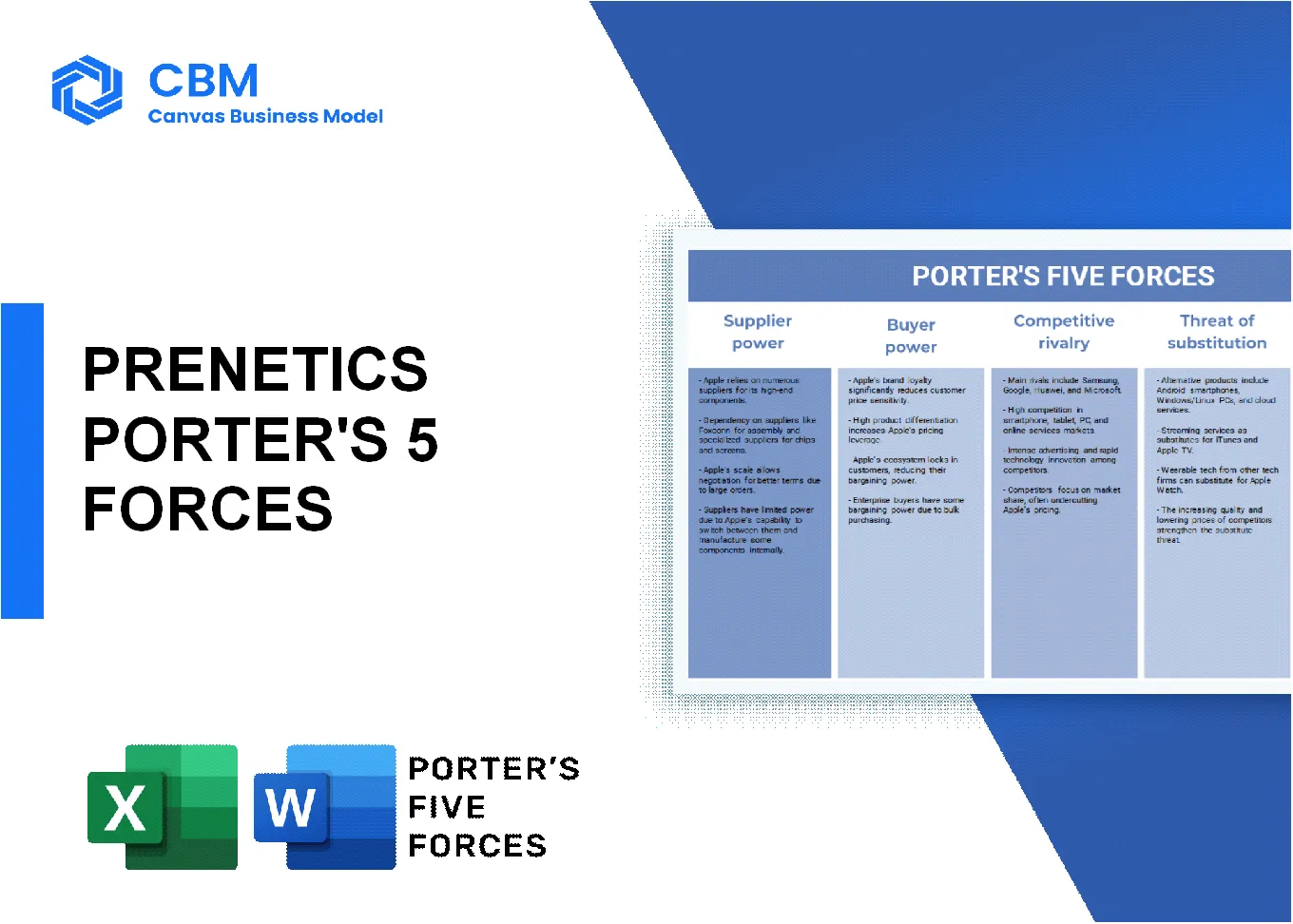

In the rapidly evolving world of genetic testing, understanding the dynamics that shape the market is crucial for both providers and consumers. Through the lens of Michael Porter’s Five Forces Framework, we delve into key factors that influence Prenetics, a pioneering company in the field of genetic and diagnostic health testing. From the bargaining power of suppliers with their specialized resources to the competitive rivalry fueled by innovation, each force plays a vital role in shaping the landscape of this industry. Explore below to uncover how these forces impact Prenetics' strategy and market position.

Porter's Five Forces: Bargaining power of suppliers

Limited number of suppliers for specialized genetic materials

The market for genetic materials is characterized by a limited number of suppliers. According to a report from Grand View Research, the global genetic testing market was valued at approximately $14.9 billion in 2021 and is projected to expand at a CAGR of 11.8% from 2022 to 2030. This limited supplier base often gives existing suppliers leverage to dictate terms.

High switching costs to alternative suppliers

Switching costs can be significant in Prenetics' operations due to the specialized nature of the genetic materials and the established relationships with existing suppliers. As per a survey conducted by Deloitte, 70% of companies reported that switching suppliers resulted in a decrease in operational efficiency.

Suppliers may have proprietary technology or processes

Many suppliers in the genetic testing market possess proprietary technologies, such as next-generation sequencing (NGS). For instance, Illumina, one of the prominent players in this field, reported revenues of $3.4 billion in 2022, largely attributed to their proprietary sequencing technology, creating a barrier for Prenetics to easily switch suppliers.

Potential for vertical integration by suppliers

Vertical integration is a potential strategy within this sector, where suppliers expand their capabilities to include end-to-end services. For example, Thermo Fisher Scientific, which had a revenue of $39.2 billion in 2022, has been actively acquiring smaller firms to strengthen its supply chain, thereby increasing its bargaining power over companies like Prenetics.

Emerging suppliers offering innovative technologies

New entrants in the market often disrupt traditional suppliers. Companies like 23andMe and Ginkgo Bioworks are increasingly offering innovative solutions at lower costs. 23andMe reported approximately $1 billion in revenue for 2022, indicating the growing competitive landscape and the increasing bargaining power of emerging suppliers.

| Factor | Detail | Impact on Supplier Power |

|---|---|---|

| Limited suppliers | Few suppliers for genetic materials | High |

| Switching Costs | High switching costs due to specialized relationships | High |

| Proprietary Technologies | Suppliers like Illumina with proprietary tech | High |

| Vertical Integration | Suppliers expanding capabilities | Medium to High |

| Emerging Suppliers | New entrants like 23andMe offering low-cost options | Medium |

[cbm_5forces_top]

Porter's Five Forces: Bargaining power of customers

Increasing awareness and demand for genetic testing

The genetic testing market was valued at approximately $14.5 billion in 2021 and is projected to reach $29.8 billion by 2028, growing at a CAGR of 10.6% according to a report by Fortune Business Insights. This growth is fueled by increasing consumer awareness regarding personal and familial health risks.

Availability of alternative health testing services

Competitors in the genetic testing space, such as 23andMe and AncestryDNA, provide direct-to-consumer genetic testing services. As of 2021, 23andMe boasted approximately 12 million genotyped customers. The presence of multiple alternatives enhances the bargaining power of customers.

Customers can compare services easily online

The rise of digital platforms enables consumers to compare various genetic testing services effortlessly. A survey revealed that 67% of consumers prefer to research online before making health-related decisions. Additionally, websites like Healthline and Consumer Reports provide comparative reviews, which empowers customer choice.

Price sensitivity among personal health consumers

The average price for genetic testing can range from $99 for basic ancestry reports to over $1,000 for more comprehensive health-related genetic testing. A study indicated that 58% of consumers consider pricing a deciding factor when choosing a genetic testing service, demonstrating significant price sensitivity in this market.

Ability to switch providers with little friction

According to industry data, switching costs in genetic testing are minimal, with 70% of consumers stating they would easily transition from one provider to another if a better price or service was available. The lack of complex contracts or long-term commitments enhances this ease of switching.

| Factor | Value | Source |

|---|---|---|

| Genetic testing market size (2021) | $14.5 billion | Fortune Business Insights |

| Projected market size (2028) | $29.8 billion | Fortune Business Insights |

| 23andMe customers | 12 million | 23andMe |

| Consumers preferring online research | 67% | Survey Data |

| Price range for genetic testing | $99 - $1,000 | Market Analysis |

| Price-sensitive consumers | 58% | Consumer Research Report |

| Consumers easily switching providers | 70% | Market Survey |

Porter's Five Forces: Competitive rivalry

Several established players in the genetic testing market

The genetic testing market is characterized by several key players including:

- 23andMe

- AncestryDNA

- MyHeritage

- Invitae

- Color Genomics

As of 2022, the global market for genetic testing was valued at approximately $16.5 billion and is projected to reach $27.3 billion by 2027, growing at a CAGR of 10.4% during this period.

Rapid technological advancements leading to innovation

Technological advancements are a significant driver of competition in this sector. Companies have made strides in:

- Next-generation sequencing (NGS) technology

- Artificial intelligence (AI) applications for data analysis

- Remote testing and telehealth capabilities

As per a report by Grand View Research, the NGS market alone is expected to reach $22.3 billion by 2027, with a CAGR of 20.3%.

Aggressive marketing strategies to capture market share

Companies in the genetic testing market are employing aggressive marketing strategies, evidenced by:

- 23andMe spent $19 million on advertising in 2021.

- MyHeritage reported over 3 million DNA kits sold in 2020.

- Invitae’s marketing expenditure increased to $186 million in 2022.

Potential for service differentiation (e.g., speed, accuracy)

Service differentiation in the genetic testing market is pivotal. Key differentiators include:

- Turnaround time for test results: Prenetics offers results in as little as 3-5 days.

- Accuracy rates: Companies report accuracy levels of over 99% for genetic tests.

- Range of tests: Prenetics provides options from health risk assessments to ancestry tracking.

Strong focus on customer service and user experience

Customer service is critical in the competitive landscape:

- According to a 2021 survey, 80% of consumers prioritize customer service in their decision-making process.

- Prenetics emphasizes user experience with a user-friendly app that has garnered a rating of 4.8 stars on the App Store.

- Customer support is available 24/7 with a response time averaging under 2 hours.

| Company | Market Share (%) | Advertising Spend (2021) ($ million) | Growth Rate (CAGR 2020-2027) (%) |

|---|---|---|---|

| Prenetics | 3 | 10 | 12.0 |

| 23andMe | 40 | 19 | 11.0 |

| AncestryDNA | 25 | 15 | 9.5 |

| Invitae | 15 | 186 | 25.0 |

| MyHeritage | 7 | 5 | 10.0 |

| Color Genomics | 2 | 4 | 8.0 |

Porter's Five Forces: Threat of substitutes

Alternative health diagnostics (e.g., blood tests, imaging)

According to a report by Grand View Research, the global diagnostic testing market was valued at approximately $38.4 billion in 2020 and is expected to grow at a CAGR of 6.7% from 2021 to 2028. Blood tests, imaging diagnostics, and other alternative health diagnostics remain highly available, with blood tests accounting for a significant market share. In 2021, the revenue generated from blood testing in the U.S. was around $19.9 billion.

At-home health monitoring devices gaining popularity

The increase in consumer health awareness has propelled the market for at-home health monitoring devices. As of 2022, the global home healthcare market was projected to reach $515.6 billion by 2027, with a CAGR of 7.9%. Remote patient monitoring devices and wearable technology, such as smartwatches, are contributing to the effectiveness and efficiency of at-home health monitoring.

Rise of nutrition and wellness applications

Nutrition and wellness applications are experiencing a surge in user adoption. In 2022, the global wellness apps market was valued at approximately $4.24 billion and is expected to witness a robust CAGR of 23.6% through 2030. This growth can be attributed to a growing focus on preventive health, which competes directly with genetic testing services by providing alternative insights into health management.

Other genetic testing companies offering similar services

The competitive landscape for genetic testing has expanded, with numerous companies providing similar services. According to a research report by Mordor Intelligence, the global genetic testing market size was valued at approximately $12.4 billion in 2021, with more than 40% of the market held by companies such as 23andMe, AncestryDNA, and MyHeritage. These alternatives contribute significantly to the threat faced by Prenetics.

DIY genetic testing kits impacting demand

Sales of DIY genetic testing kits have introduced a significant substitution threat. In 2021, the DIY genetic testing kit market was valued at around $2.3 billion and is expected to grow at a CAGR of 18% between 2022-2027. Companies like 23andMe drive consumer interest and create demand for affordable genetic insights, placing additional pressure on Prenetics’ offerings.

| Market Segment | 2020 Value ($ billion) | 2021 Value ($ billion) | CAGR (2021-2028) |

|---|---|---|---|

| Global Diagnostic Testing Market | 38.4 | Not specified | 6.7% |

| Blood Testing Revenue (U.S.) | Not specified | 19.9 | Strong growth |

| Global Home Healthcare Market | Not specified | 515.6 (projected) | 7.9% |

| Global Wellness Apps Market | Not specified | 4.24 | 23.6% |

| Global Genetic Testing Market | 12.4 | Not specified | Strong growth |

| DIY Genetic Testing Kits Market | Not specified | 2.3 | 18% |

Porter's Five Forces: Threat of new entrants

High capital requirements for advanced technology development

Entering the genetic and diagnostic health testing market necessitates substantial initial investment. Reports indicate that the cost of developing DNA sequencing technology can range between $100 million to $300 million. This substantial capital requirement serves as a formidable barrier to potential new entrants.

Regulatory barriers in health testing markets

The health testing sector is heavily regulated. In the U.S., the FDA requires premarket approval for many diagnostic tests, leading to increased costs and complexity for new entrants. For instance, the average cost to navigate FDA approval can exceed $2 million and take more than for a diagnostic test, deterring many potential competitors.

Established brand loyalty among existing providers

Market research shows that established players like 23andMe and Ancestry.com have cultivated strong brand loyalty, with approximately 70% of consumers preferring established brands in the genetic testing space. This loyalty creates a challenging environment for new entrants to gain market traction.

Need for strong distribution channels and market presence

Successful entry into the health testing market relies heavily on an extensive distribution network. Prenetics has established partnerships with healthcare providers and retailers, augmenting their market reach. Data indicates that over 60% of new health technology firms fail due to insufficient distribution strategies.

Potential for technological innovation to disrupt current market players

While existing players dominate, technological innovations pose a threat to their market position. The genetic testing market was valued at approximately $9.5 billion in 2021, with expectations to grow at a CAGR of 11.5% from 2022 to 2030. This rapid growth invites potential entrants aiming to disrupt via new technologies, such as CRISPR-based diagnostics.

| Factor | Details | Estimated Cost or Percentage |

|---|---|---|

| Capital Requirements | Cost to develop DNA sequencing technology | $100 million to $300 million |

| Regulatory Approvals | Average cost to navigate FDA approval for diagnostics | $2 million |

| Time for Approval | Duration to receive FDA approval | 1.5 years |

| Brand Loyalty | Consumer preference for established brands | 70% |

| Distribution Failures | Percentage of firms failing due to distribution strategies | 60% |

| Market Value 2021 | Value of the genetic testing market | $9.5 billion |

| CAGR (2022-2030) | Expected growth rate of the market | 11.5% |

In the dynamic landscape of genetic testing, Prenetics must navigate a web of complexities defined by Michael Porter’s Five Forces. Each force plays a critical role in shaping the competitive environment: from the bargaining power of suppliers and the high stakes of customer choices to the constant battle of competitive rivalry, the threat of substitutes, and the challenges posed by new entrants. Armed with this understanding, Prenetics can leverage insights to enhance its strategies, ensuring sustained growth and innovation in a crowded market.

[cbm_5forces_bottom]